The Coronavirus crisis is posing a number of challenges to businesses and business owners, with such challenges likely to continue even once the lock down is lifted. With that in mind, here are some thoughts about ways in which you can protect your business in the long run, be it through a company reorganisation, the issue of share options, or through its contractual arrangements.

Business Reorganisations

Your underlying business assets may be highly valuable; however, difficult economic conditions can result in the trading side of your business suffering from cash flow issues, putting such assets at risk in the event that part of the business fails. For example, your company might hold a valuable investment asset such as a property, have valuable intellectual property rights and goodwill, or have different areas of trade.

Potential buyers or investors in the company may also have reservations where, for example, a company has two distinct areas of trade and they are only looking at acquiring one area, or a company which also owns a property which a buyer does not wish to acquire as part of the business.

In these types of situation, you might want to consider ways in which these assets can be separated from the company and placed within separate entities.

One potential way of achieving this is through utilising the procedure of Section 110 Insolvency Act 1986. This is a process by which a business or assets within a company are moved into another limited company, or companies. It is commonly referred to as a “110 reorganisation”.

The process involves the creation of a new parent company (Topco) which takes ownership of the main trading company (Holdco) from its current shareholders through what is called a “share for share” exchange whereby Topco acquires the entire issued share capital of Holdco from the shareholders, in consideration for the issue of shares in Topco to the shareholders.

Following this step, the relevant business assets of Holdco are transferred up to Topco (this is known as a “hive up”). The process is then started to liquidate Topco and liquidator is appointed. As part of the liquidation process, the relevant business assets of Topco are transferred by the liquidator to newly incorporated companies (Newcos). These are often incorporated at the same time as Topco. In consideration for the transfer of the business assets, each Newco will issue shares to Topco.

Finally, as part of the winding up of Topco, the liquidator will transfer the shares in the Newcos to the shareholders of Topco (usually in proportion to their original shareholdings in Holdco). Topco will then be liquidated and dissolved.

A section 110 reorganisation will require very careful planning from a tax, accountancy and legal perspective. There are number of tax reliefs available in connection with a section 110 liquidation scheme of which participants may be able to take advantage. It is important therefore that business owners seek specialist tax advice before deciding whether to go down this course.

Below is an example of how a section 110 reorganisation might work in practice.

Background

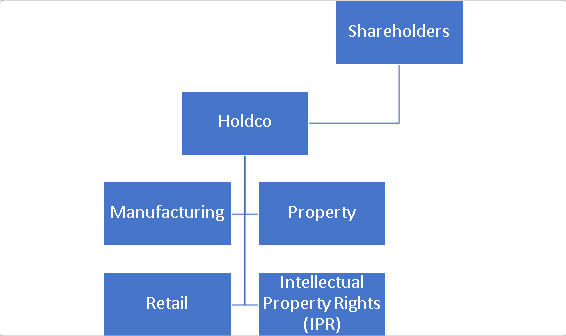

Bits N Bobs Ltd (Holdco) is a manufacturer of widgets. It distributes its widgets together with other products from a number of retail outlets which premises are rented. It also owns the factory building from which it manufactures its widgets, part of which is let out to another business. The widgets have a unique design and brand, the intellectual property rights to which are owned by Holdco, which the board are interested in licencing to other manufacturers around the world.

The shareholders of Holdco (who are also the directors) have concerns that the retail element of the business may be vulnerable as more and more widget sales are being made over the internet rather than in store. Holdco is in the middle of a ten year lease at two of its stores. Demand, however, remains high for the widgets themselves and there is growing interest from manufacturers and distributors in Germany and France about the widgets.

The shareholders decide that they would like to separate out the different parts of the business. They would like to keep the distribution element of the business within Holdco, and put the manufacturing, property and intellectual property elements into separate companies.

At this stage the structure of the business is as per the below table:

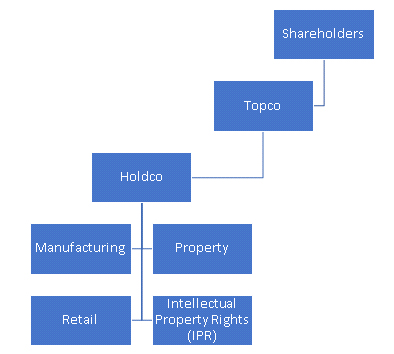

Step One

Four new companies are incorporated:- Topco; Propco; IPRco; and Manuco

The shareholders sell their shares in Holdco to Topco in consideration for shares in Topco being issued to them, following which the group structure looks like this:

Step Two

There is a transfer (or hive up) of the manufacturing business assets, the property and the IPR from Holdco to Topco.

Step Three

The shareholders of Topco hold a general meeting to approve the section 110 liquidation scheme and propose a resolution to appoint and authorise the liquidators to carry out the scheme.

Step Four

There is a second general meeting at which the members vote to pass special resolutions for:

- The winding-up of Topco by means of an MVL.

- Appointing liquidators.

Step Five

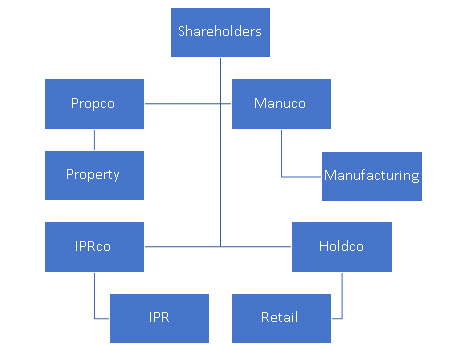

The newly appointed liquidator will then arrange for the transfer of the assets of Topco to Propco; IPRco; and Manuco accordingly. In consideration for the transfer of assets, each company issues shares to the liquidator. Those shares are then transferred to Topco's shareholders, in proportion to their respective shareholdings in Topco. This is in satisfaction of their rights on the winding up of Topco. In practice, the shares in the companies are often issued directly to the shareholders.

Step Six

Following the asset transfer, the liquidator will continue the wind up of Topco which will then be eventually dissolved,

Final Structure

The final structure will then appear as follows:

As you will see the various business assets are now owned by the different companies within the group, rather than being tied up in a single company.

The above is a basic example of how a 110 re-organisation may look in practice, and there are other structures which may be implemented. For example, the business assets could be place in a subsidiary below the various newcos in which the shareholders hold their shares.

Share Options

As employers are increasingly needing to have difficult conversations with employees regarding possible pay cuts and redundancies, one thing they could consider is offering share options in place of their reduced salary.

An employee share option is, as the name suggests, an option for an employee to acquire shares in a company at a pre-set price which option may be exercised upon the happening of certain events (often a sale of the entire issued share capital of the Company).

Why consider share options?

There are many reasons to consider a grant of employee share options including:

- Aligning the interests of employees with shareholders, by ensuring that employees have an interest in the value of the company's shares increasing, or an interest in getting the company to a sale or flotation.

- Share options are generally lost when an employee leaves employment. It therefore can assist with encouraging loyalty and job retention for key employees.

- The opportunity for possible share options can also encourage recruitment.

- If the company does not have the cash available to pay larger salaries it may use options to remunerate employees in the longer term.

- With certain share options these may have tax advantages such as the employer not being liable to pay employer NICs on option gains.

With this in mind, employee share options may be an attractive option in these difficult times, particularly in terms of motivating a workforce that may find themselves on a reduced salary, to grow the business.

Terms of Business

The COVID-19 crisis has resulted in many businesses finding themselves in the position of being unable to fulfill their contractual obligations and, as a consequence, in legal disputes.

It is, therefore, worth considering a review of your business’s general terms and conditions and contracts – 1) to see whether you are protected in the event that your business is struggling to fulfill its contractual obligations and 2) to check your protections in the event that the counterparty to a contact defaults on its obligations.

There are a number of ways in which your protections can be “beefed” up, be it through a “force majeure” provision or, on the other hand, a requirement for monies up front, so now is a good time for your lawyer to review these.

For help or advice on structuring or re-structuring your business and your options, please speak to Roy Colaba on 0808 166 8827 or email r.colaba@sydneymitchell.co.uk

|

|

|

|

|

|

|